Last week’s update covered the way in which RefToken will democratise the ability for small businesses to compete head to head with global corporations by eliminating marketing inefficiencies that essentially price out small players. This week we’ll take a slightly more granular approach and analyse the mechanics of how RefToken’s marketing platform empowers small businesses to global growth.

For the sake of this exercise we’ll take a peer to peer lending start-up that has successfully raised funding via it’s ICO and is looking to on-board lenders and borrowers. There are several of these companies out there, and many of our readers have participated in ICOs of the sort so the use-case will be of interest.

The primary challenge facing such a company is the dichotomy between the target markets encompassing borrowers and lenders. Borrowers tend to be unbanked individuals in developing countries, whilst lenders tend to be located in developed countries boasting a service oriented economy with a population sophisticated enough to understand the financial and humanitarian aspects of peer to peer lending to unbanked individuals across the world. The company will need to reach out to two very different audiences, in two very different markets with separate propositions and messages, with a failure in one market failing the counterpart market. This would require a significant amount of human and financial resources to execute in-house.

Using RefToken’s pay-per-performance marketing platform the company would be able to publish a set of market specific deals which affiliates operating in their target market would be able to browse and sign up to. The company’s marketing team will also be able to browse the platform’s affiliate directory, filtering by country and sector to build up a list of potential partners they can message and propose a deal though, all within the platform, conveniently sidestepping the time-consuming tasks of hunting down staff members on LinkedIn and cold messaging them there, (or emailing the unmanned honey-pot email address in site footers).

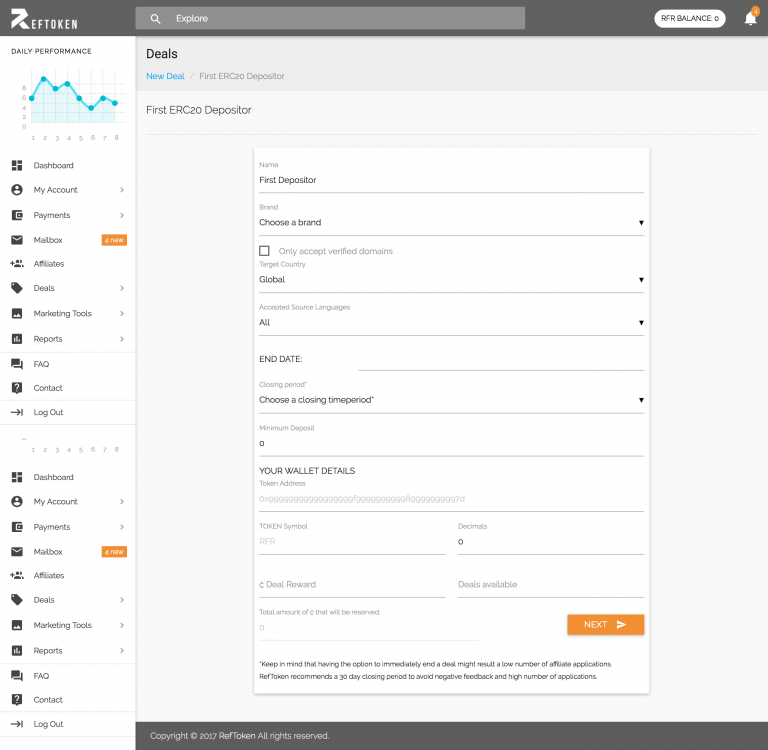

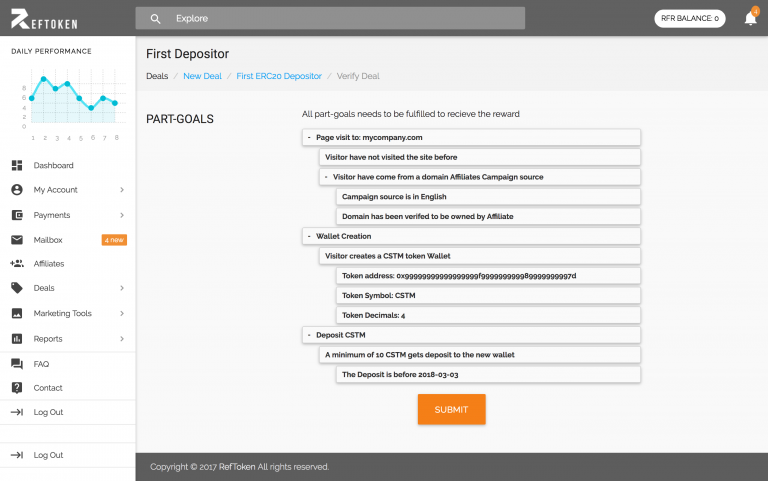

The company’s marketing team understands that participation in peer to peer lending is not an impulse purchase, and has a solid lifecycle email strategy set up in their CRM tool, that converts 20% of registered lenders to eventually participate in a loan. It knows that its average revenue per user (ARPU) to be €1000, meaning that it can offer the below deal structure which is published on their merchant profile as well as on a central list of fintech related deals, allowing for easier discovery by potential affiliates. All deals are governed and executed by a smart contract.

- Goal 1 Requirements (pay-out €100)

- Registered KYC/AML cleared lender

- Goal 2 Requirements (pay-out €200)

- Lender participates in first loan

- Loaned amount > €50

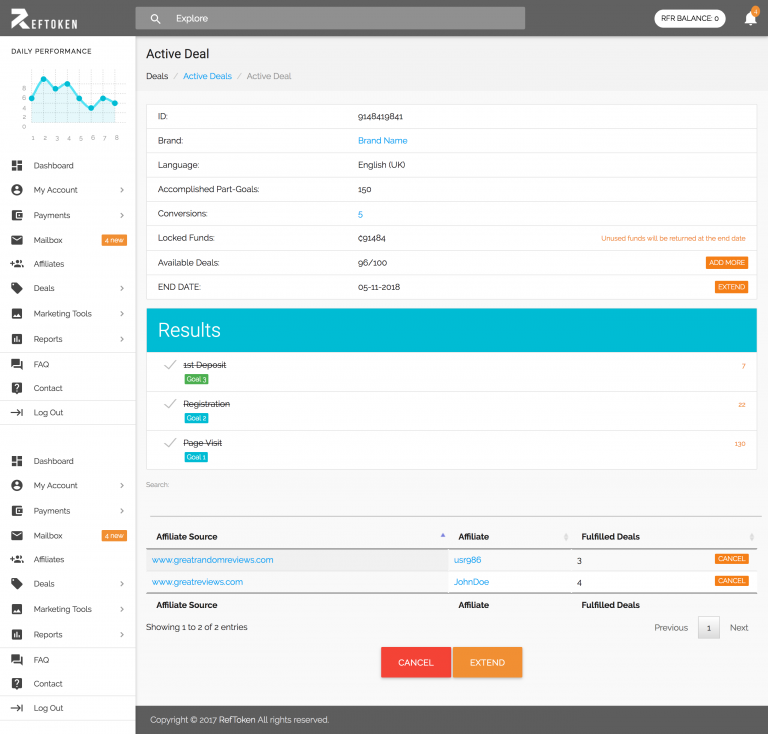

Affiliates get notified of the deal and sign up to it. The company can then review them if they so desire (by checking their feedback pages on the platform, vetting their websites and connected company social profiles) and approve their participation.

Once approved the affiliates are then free to browse the company’s media gallery for the material required for their campaign (or request new creative to the required specs) and begin promoting the deal.

The RefToken platform will report KPIs in real time, allowing the affiliate to see how their campaign is performing and is instantly issued payment by the smart contract governing the deal each time one of the goals is met, solving one of affiliate marketer’s greatest pain points which is cash flow and liquidity.